Irs Standard Meal Allowance 2024. 2023 meals and entertainment deduction. If this applies, you can claim a standard meal allowance of $69 a day ($74 for travel outside the continental united states) for travel in 2023.

Actual cost of meals that aren’t considered lavish or extravagant. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Federal Per Diem Rates Consist Of A Maximum Lodging Allowance Component And A Meals And Incidental Expenses (M&Amp;Ie) Component.

Actual cost of meals that aren’t considered lavish or extravagant.

The Gsa Website Lists These Rates By Location.

As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals is changing.

The Irs Guidance On Business Meals Notes That “The Food And Beverages Must Be Provided To A Current Or Potential Business Customer, Client, Consultant, Or.

Images References :

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Rates are set by fiscal year, effective oct. The irs guidance on business meals notes that “the food and beverages must be provided to a current or potential business customer, client, consultant, or.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, The irs guidance on business meals notes that “the food and beverages must be provided to a current or potential business customer, client, consultant, or. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Source: www.pinterest.com

Source: www.pinterest.com

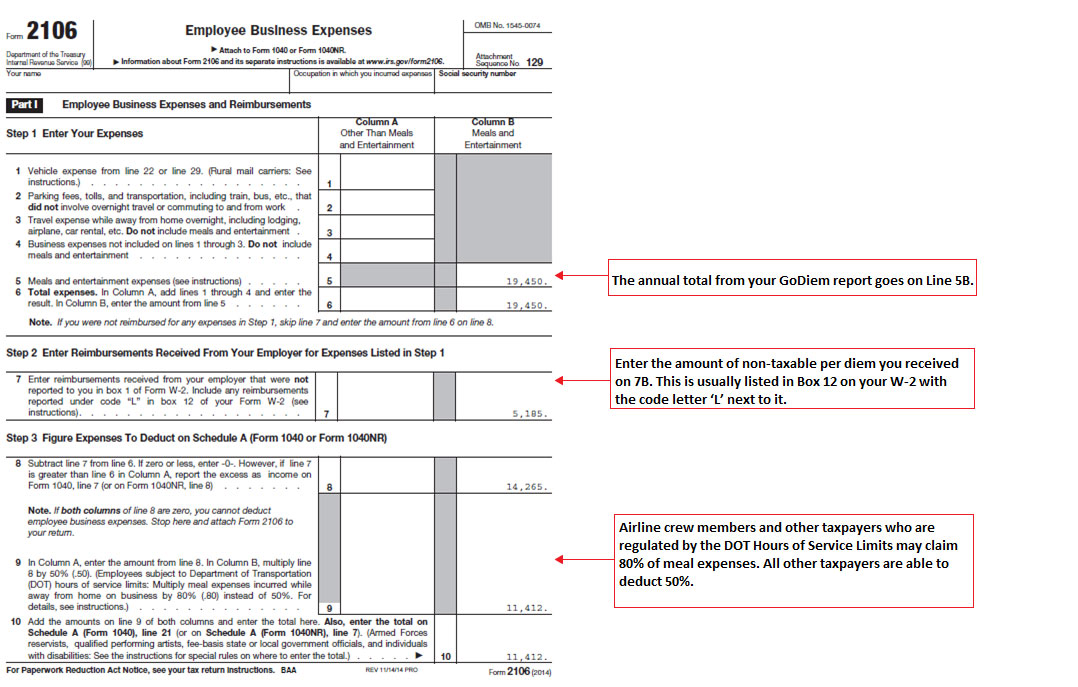

IRS Meal Allowance Irs, Allowance, Meals, The allowance is a set per diem rate under federal meals and incidental expenses. The irs guidance on business meals notes that “the food and beverages must be provided to a current or potential business customer, client, consultant, or.

Source: neswblogs.com

Source: neswblogs.com

Irs Tax Brackets 2022 Married Jointly Latest News Update, The meals and incidental expense (m&ie) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished. And $74 for any travel outside of the lower 48.

Source: cdennehycpa.com

Source: cdennehycpa.com

Individual Tax Preparation Services Christopher Dennehy, CPA, Standard meal allowance determined by the irs. And $74 for any travel outside of the lower 48.

Source: www.carfare.me

Source: www.carfare.me

Irs 2019 Daycare Daily Meal Allowance carfare.me 20192020, This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the. Federal per diem rates consist of a maximum lodging allowance component and a meals and incidental expenses (m&ie) component.

Source: www.progressive-charlestown.com

Source: www.progressive-charlestown.com

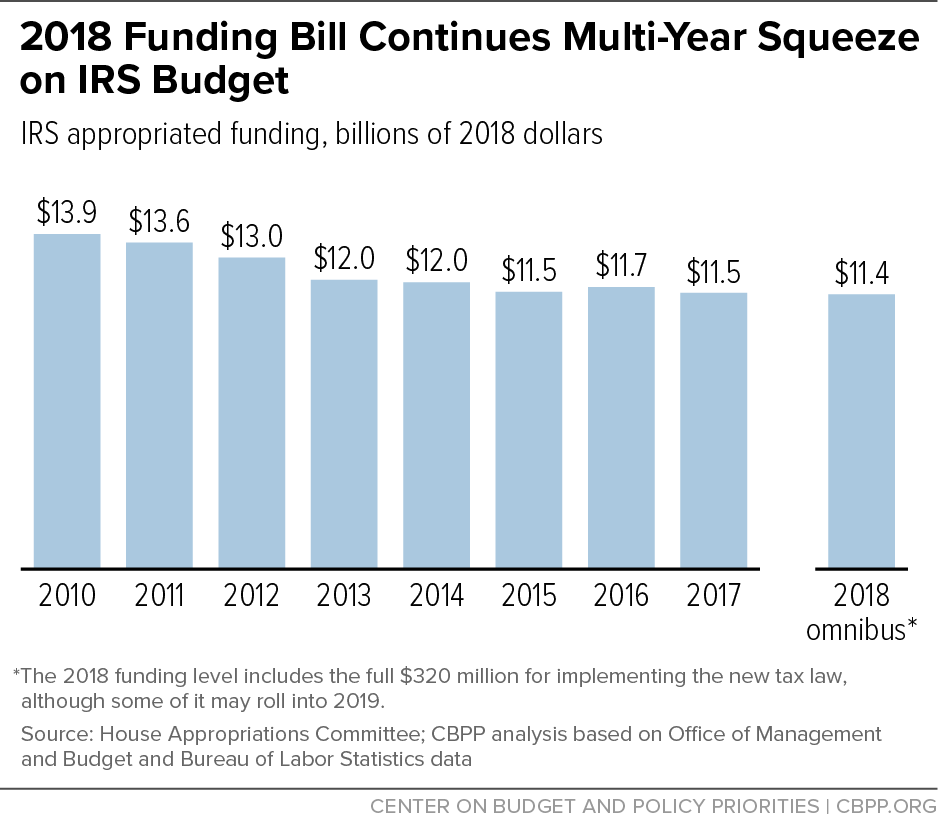

Progressive Charlestown Fewer staff mean more tax cheating, The standard meal allowance, which is the federal meals and incidental expense (m&ie) per diem rate. Page last reviewed or updated:

Source: form-1040v.com

Source: form-1040v.com

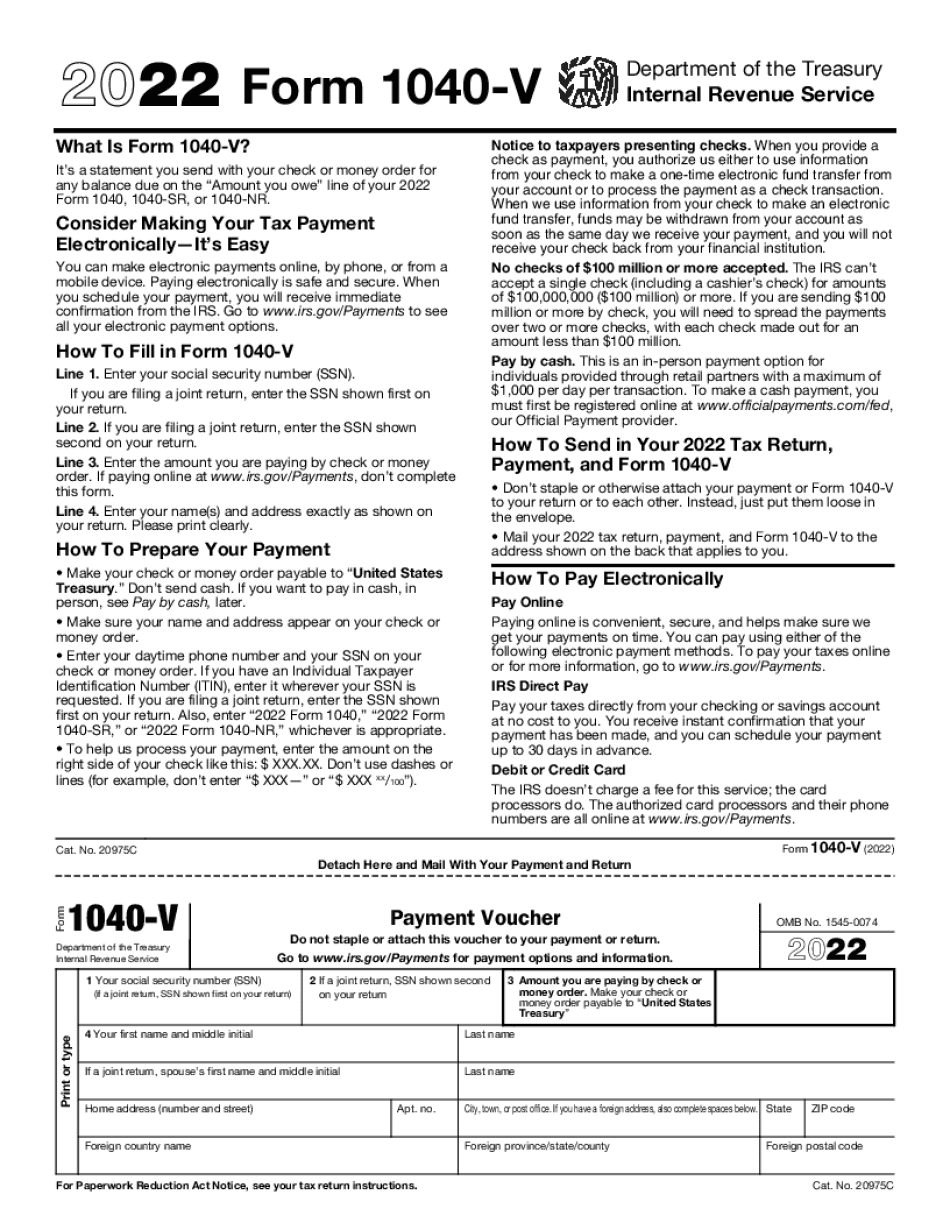

Irs form 1040v 20222023 Fill online, Printable, Fillable Blank, As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals is changing. This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the.

Source: www.hotelengine.com

Source: www.hotelengine.com

How to Plan a Meal Allowance for Employee Travel Hotel Engine, Page last reviewed or updated: This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the.

Source: www.paycat.com.au

Source: www.paycat.com.au

MA000104 Meal Allowance Overtime, Actual cost of meals that aren’t considered lavish or extravagant. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

The M&Amp;Ie Rate Will Stay At $69 Per Day For Travel Within The Continental U.s.

According to the updated information, the trucker per diem rate in 2024 is $69 for locations within the continental united states (conus) and $74 for regions.

Page Last Reviewed Or Updated:

The gsa website lists these rates by location.